© Copyright 2024 Practice Catapult LLC All Rights Reserved.

OrthoCatapult is unlike any other solution for orthodontic practices. With OrthoCatapult, treatment coordinators close more cases, patients enjoy a better experience, and your practice realizes its growth potential — or your money back.*

Yes, you read that right. We guarantee more than three times the industry’s average annual practice growth during your first year of using OrthoCatapult, or we’ll refund your entire subscription fee.*

Zero risk. All reward. Let’s get started today!

OrthoCatapult is so intuitive, there’s virtually no learning curve for new team members or patients and the initial implementation is a breeze. We take great pride in our painstaking development process that made OrthoCatapult this easy to implement and use.

OrthoCatapult works non-stop for your sales and management team members as their expert digital assistant to help them achieve unprecedented results and professional development. It helps optimize your team’s strengths while minimizing individuals’ weaknesses that are costing your practice daily.

“Pending” Starts Growth

(1st Year Average)

Overall Starts Growth

(1st Year Average)

Client Satisfaction

“My conversion rate wouldn’t be this high without OrthoCatapult. It’s definitely a TC’s best friend.”

“The practice has taken off tremendously and I give a lot of credit to OrthoCatapult for that.”

“I can’t imagine going back to doing it without OrthoCatapult and I know my TCs can’t either.”

“OrthoCatapult’s streamlined our new patient process which patients love as much as I do!”

“I give OrthoCatapult my highest recommendation. It’s simply a must-have for any orthodontic practice.”

“We’re so glad we switched to OrthoCatapult. The transition from our previous solution was surprisingly painless and we are much happier with OrthoCatapult.”

“The folks at OrthoCatapult are great. They are forward-thinking, solicit feedback, and deliver on their promises. It’s refreshing.”

“Patient follow-up with OrthoCatapult is AMAZING!”

“OrthoCatapult is a must-have… it’s a real game-changer.”

“I’ve been using OrthoCatapult now for three years, I wouldn’t want do this job without it.”

“It’s simply a must-have for any growing orthodontic practice.”

“Within the first week of using OrthoCatapult, we were amazed at how efficient it was compared to our previous process. There’s no turning back!”

“OrthoCatapult is the most efficient and effective sales tool we’ve found.”

“What’s not to love? OrthoCatapult saves me tons of time and busywork, allowing me to focus on building patient rapport.”

“If you care about the health of your practice and team, you owe it to yourself to check out OrthoCatapult.”

“I really liken it to an iPhone. When you get it, you instinctively know how to use every portion of it.”

“OrthoCatapult includes the finest analytical tool on the market today for orthodontic practices.”

“Instead of punching in numbers and preparing documents the old-fashioned way, I can give patients my full attention while OrthoCatapult does the rest.”

“Within the first week of using OrthoCatapult, we were amazed at how efficient it was compared to our previous process. There’s no turning back!”

As an all-in-one solution for sales and patient relationship management, OrthoCatapult is in a league of its own. Its tools integrate seamlessly with one another to save your team time and energy while optimizing results.

Plus, you get the entire OrthoCatapult solution and all its benefits for less than the monthly expense of a part-time minimum wage employee! At this value and with our 10% growth guarantee*, your practice can’t afford not to leverage OrthoCatapult.

FACT: 83% of human learning is visual. Educate patients with your own HIPAA-compliant case gallery, patient testimonials, and educational videos, using OrthoCatapult’s built-in patient education tool, OrthoGallery®.

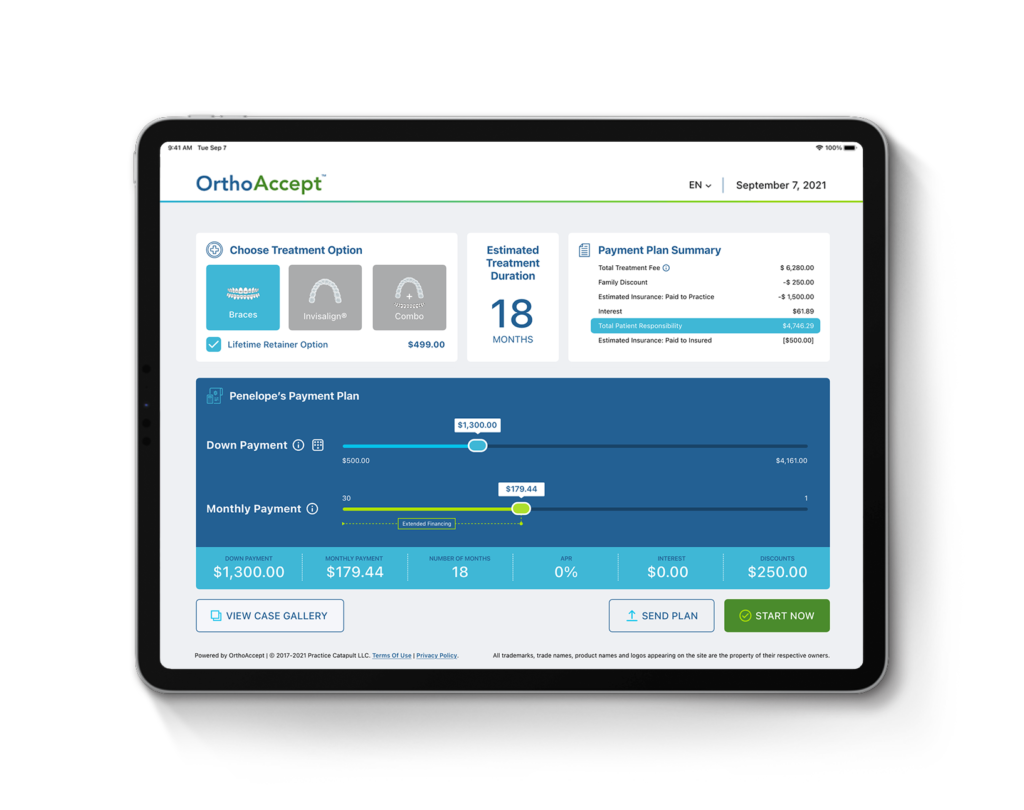

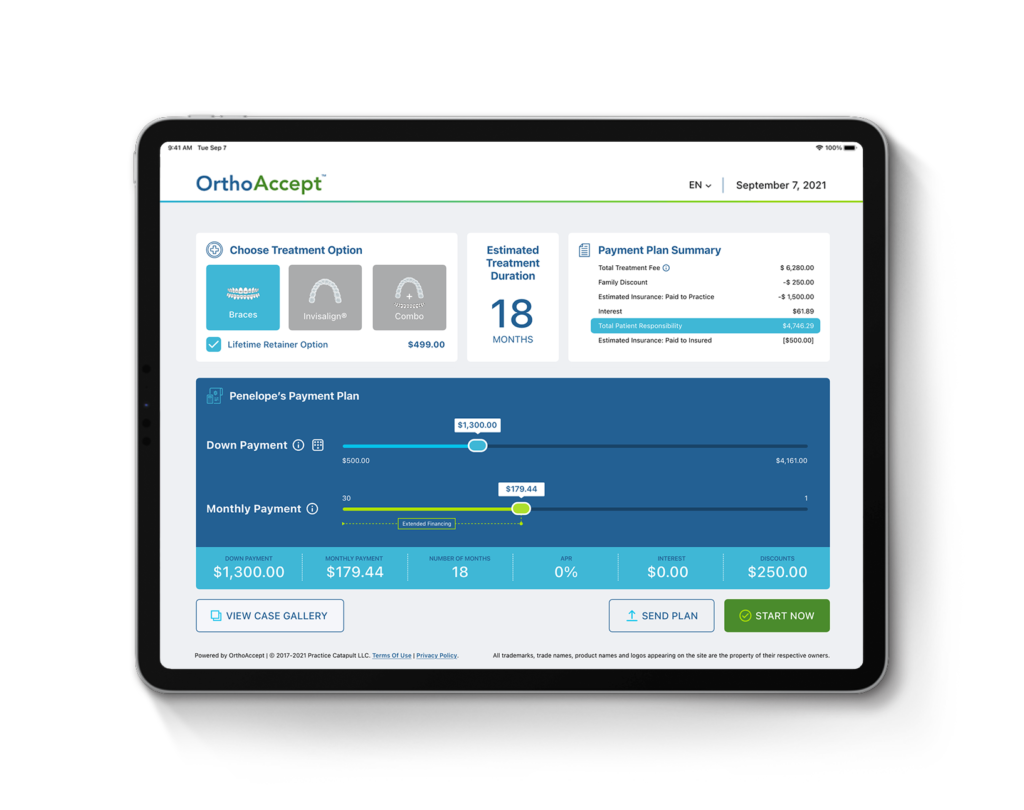

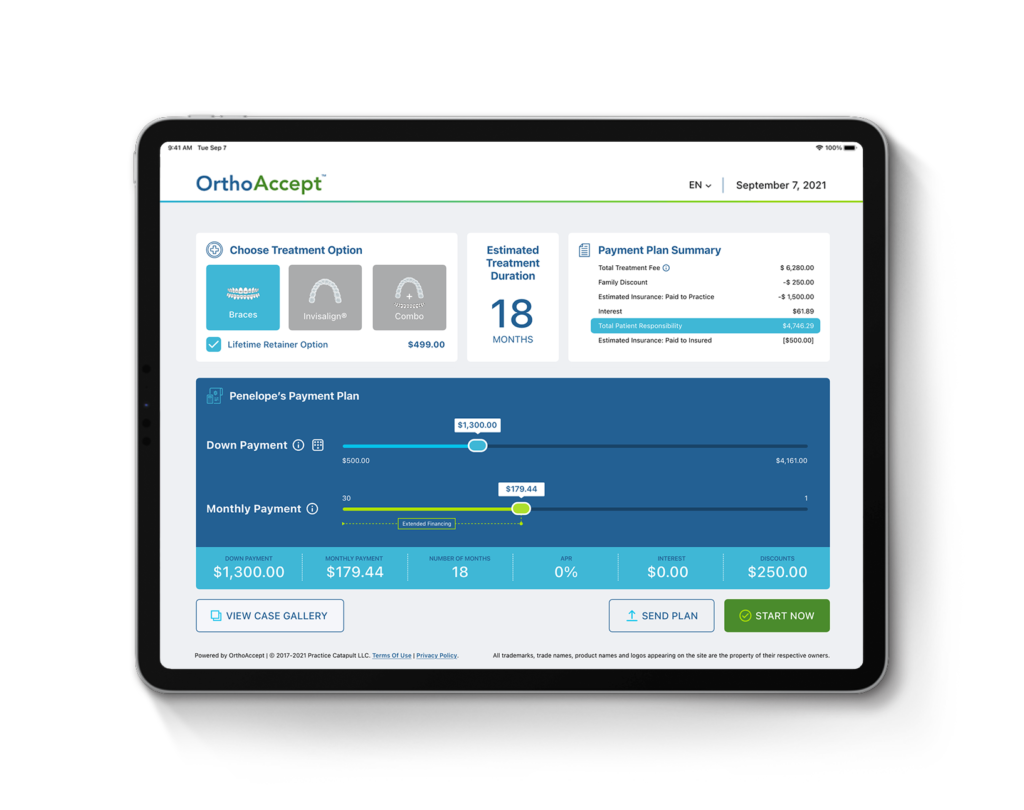

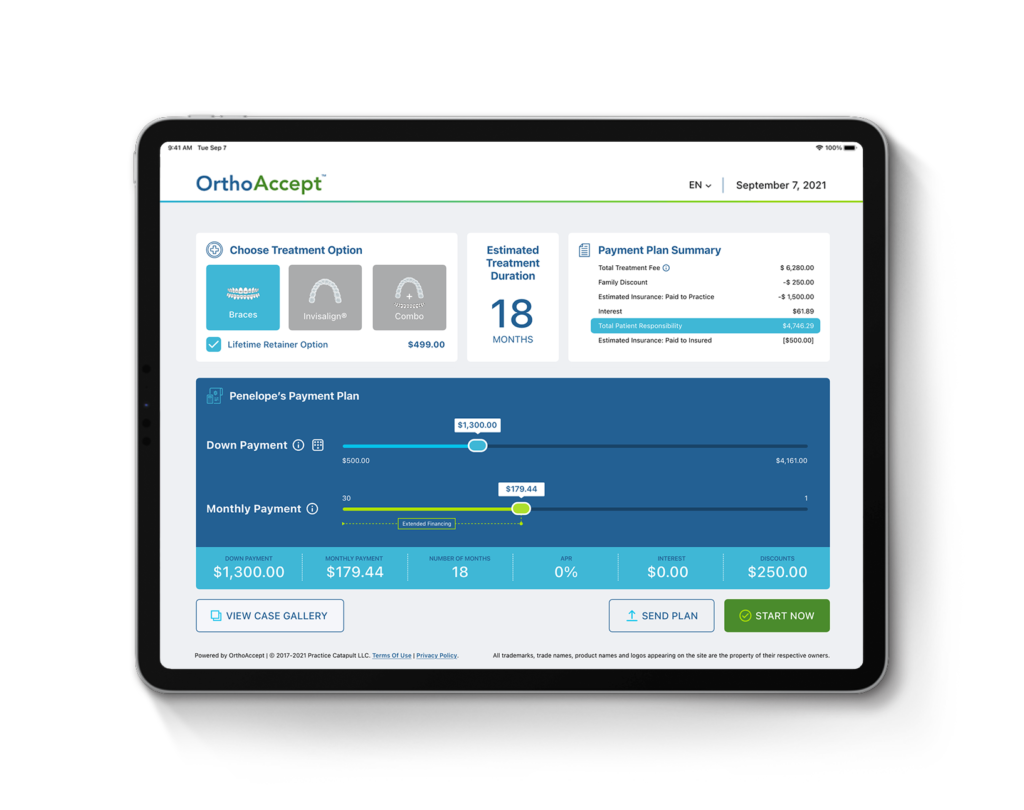

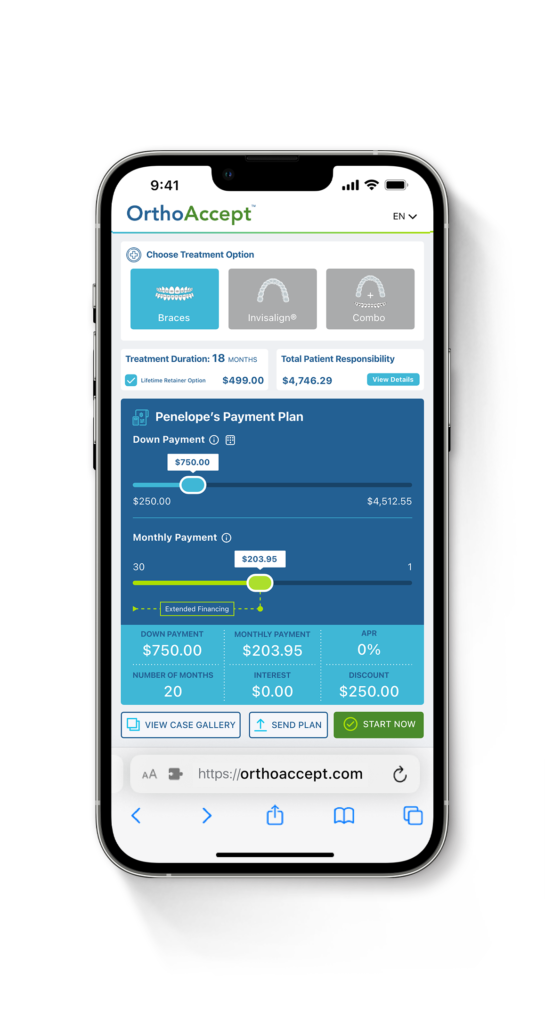

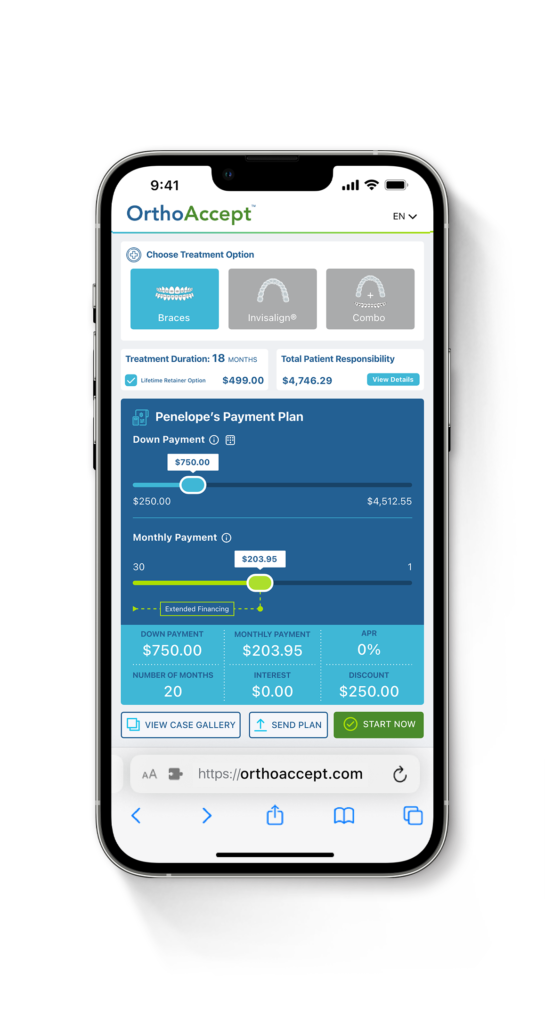

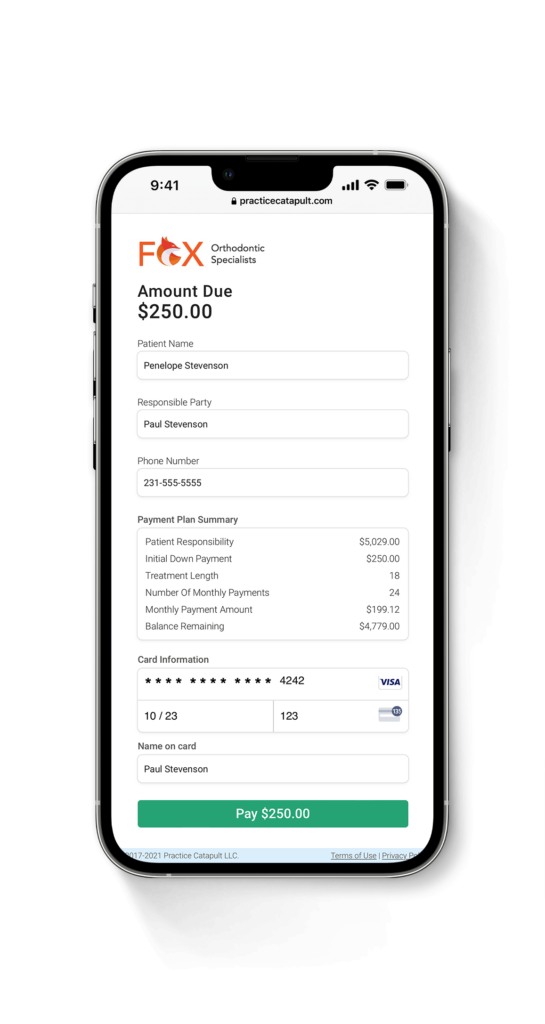

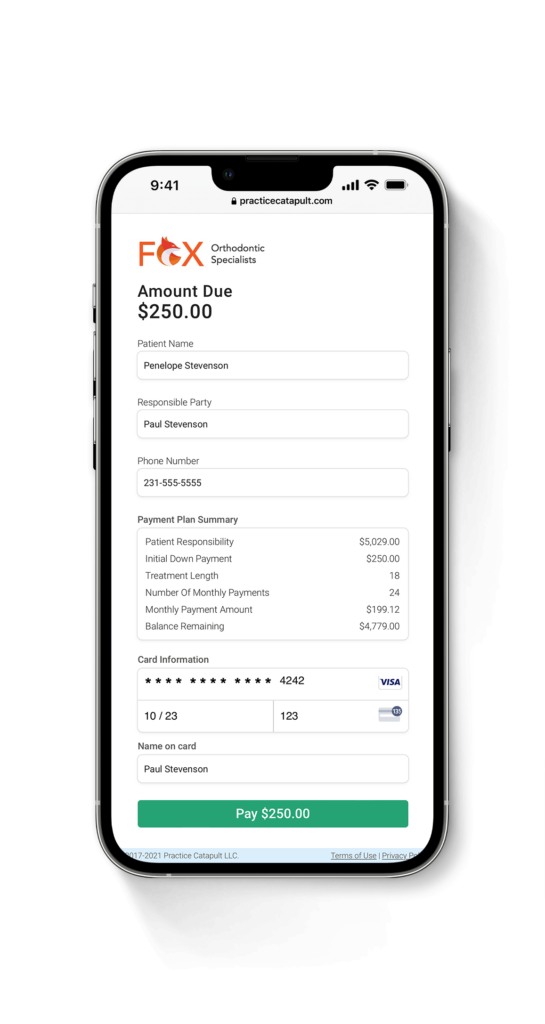

Learn MoreFar more than the typical payment “slider”, OrthoCatapult’s intuitive payment calculator, OrthoAccept®, has unmatched capabilities and flexibilities, resulting in more patients saying “yes” to treatment both in-office and at-home.

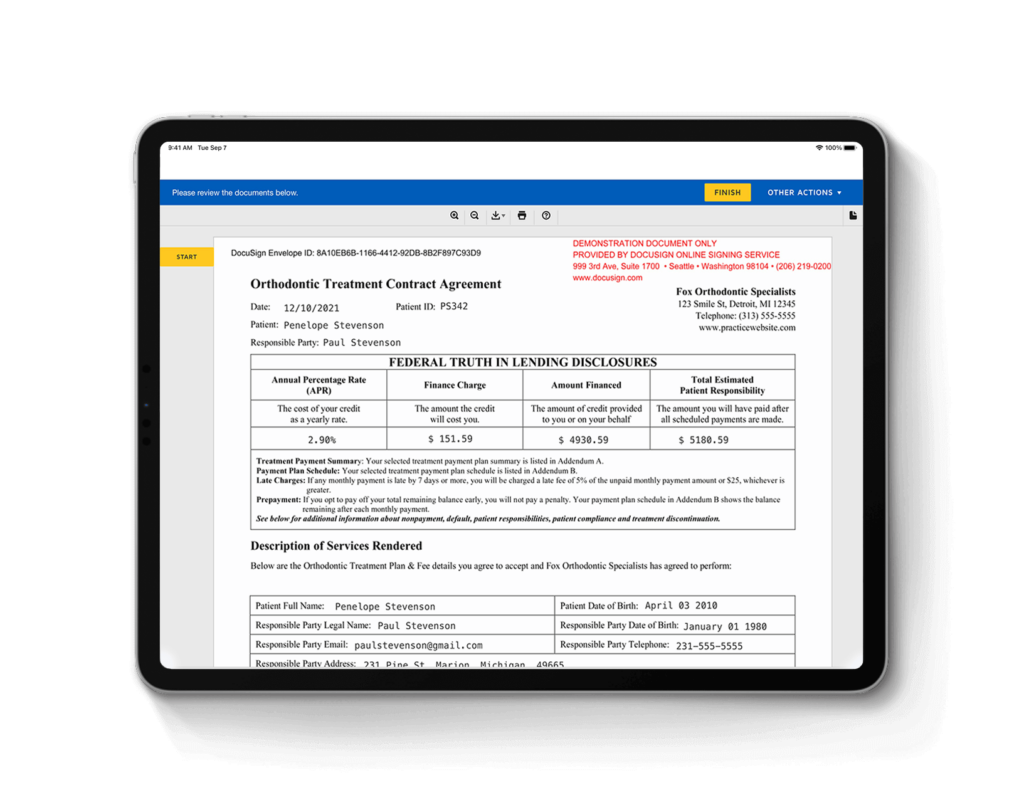

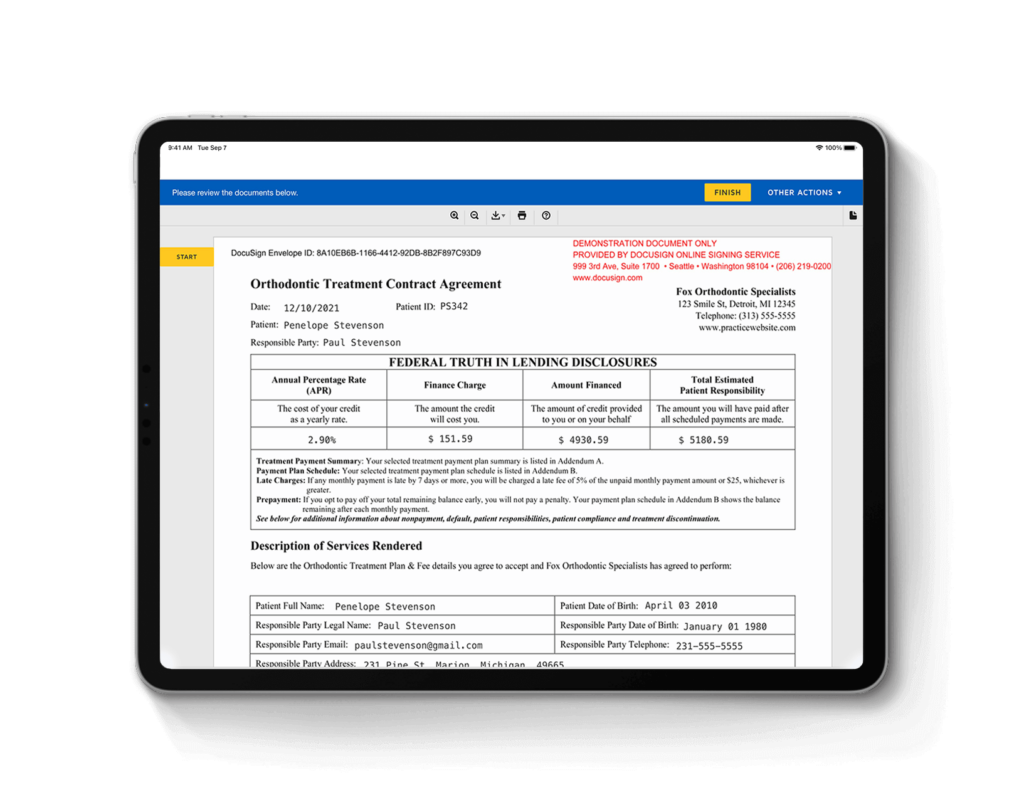

Learn MoreDo you want to save time, money, and resources? In-office or at-home, all OrthoCatapult patient contracts are signed via DocuSign®, the most trusted & secure eSignature solution.

Learn MoreWith OrthoCatapult’s seamless digital workflow, families can now accept their payment plan, sign their contract, and make their down payment at home. Everything that was shared with them in-office is available to them at home, on any device.

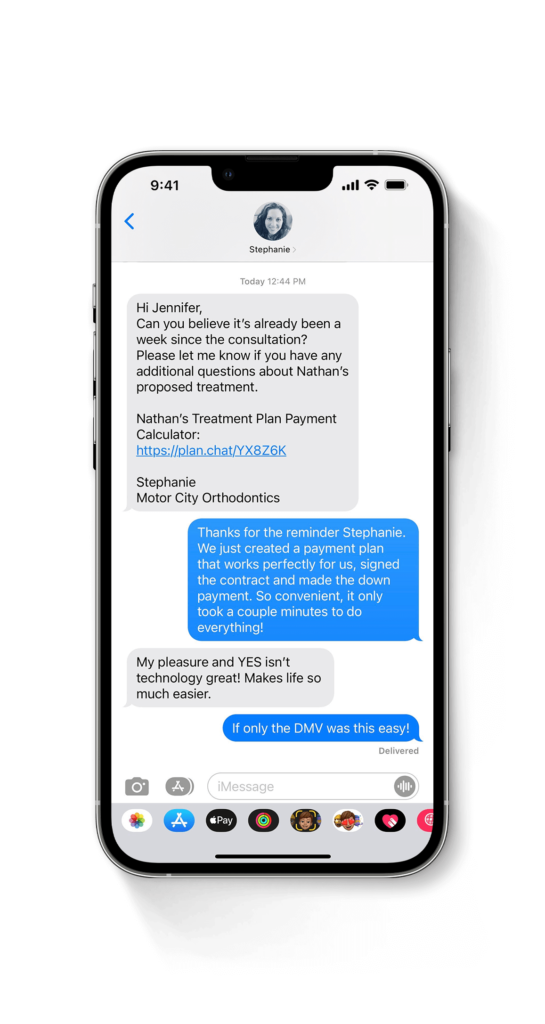

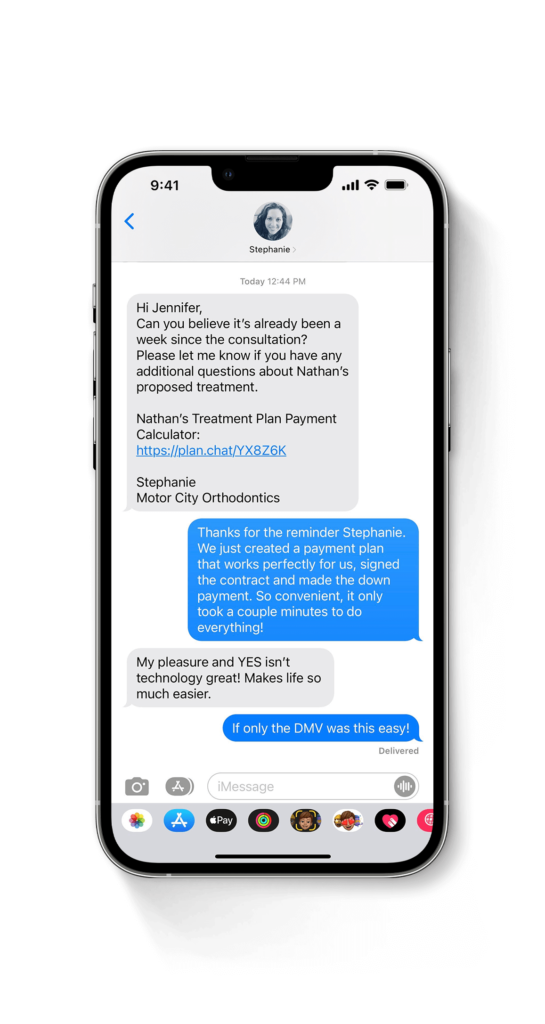

Learn MoreTreatment Coordinators don’t have enough time to manually follow up with every “pending” patient 7+ times, as recommended; luckily, OrthoCatapult automates the entire follow-up process for them with perfectly timed, expertly crafted email and text messages, resulting in significantly more “pending” starts.

Learn MoreBusy patients and parents expect and demand convenience. Make down payments easy for your “pending” starts; let them pay online immediately after signing their contract using any device.

Learn MoreConduct virtual new-patient consultations and existing-patient checkups using any internet browser on any mobile device. OrthoCatapult’s built-in virtual appointment tool, OrthoConnect®, is completely secure and HIPAA-compliant.

Learn MoreEasily track and optimize your team’s performance with OrthoCatapult’s real-time, built-in analytical tool, OrthoAnalytics®. Leverage OrthoCatapult’s unique sales-oriented insights and key performance indicators (KPIs) to maximize your practice’s growth.

Learn MoreFACT: 83% of human learning is visual. Educate patients with your own HIPAA-compliant case gallery, patient testimonials, and educational videos, using OrthoCatapult’s built-in patient education tool, OrthoGallery®.

Far more than the typical payment “slider”, OrthoCatapult’s intuitive payment calculator, OrthoAccept®, has unmatched capabilities and flexibilities, resulting in more patients saying “yes” to treatment both in-office and at-home.

Do you want to save time, money, and resources? In-office or at-home, all OrthoCatapult patient contracts are signed via DocuSign®, the most trusted & secure eSignature solution.

With OrthoCatapult’s seamless digital workflow, families can now accept their payment plan, sign their contract, and make their down payment at home. Everything that was shared with them in-office is available to them at home, on any device.

Treatment Coordinators don’t have enough time to manually follow up with every “pending” patient 7+ times, as recommended; luckily, OrthoCatapult automates the entire follow-up process for them with perfectly timed, expertly crafted email and text messages, resulting in significantly more “pending” starts.

Busy patients and parents expect and demand convenience. Make down payments easy for your “pending” starts; let them pay online immediately after signing their contract using any device.

Conduct virtual new-patient consultations and existing-patient checkups using any internet browser on any mobile device. OrthoCatapult’s built-in virtual appointment tool, OrthoConnect®, is completely secure and HIPAA-compliant.

Easily track and optimize your team’s performance with OrthoCatapult’s real-time, built-in analytical tool, OrthoAnalytics®. Leverage OrthoCatapult’s unique sales-oriented insights and key performance indicators (KPIs) to maximize your practice’s growth.

This document informs Users about the technologies that help this Website to achieve the purposes described below. Such technologies allow the Owner to access and store information (for example by using a Cookie) or use resources (for example by running a script) on a User’s device as they interact with this Website.

For simplicity, all such technologies are defined as “Trackers” within this document – unless there is a reason to differentiate.

For example, while Cookies can be used on both web and mobile browsers, it would be inaccurate to talk about Cookies in the context of mobile apps as they are a browser-based Tracker. For this reason, within this document, the term Cookies is only used where it is specifically meant to indicate that particular type of Tracker.

Some of the purposes for which Trackers are used may also require the User’s consent, depending on the applicable law. Whenever consent is given, it can be freely withdrawn at any time following the instructions provided in this document.

This Website uses Trackers managed directly by the Owner (so-called “first-party” Trackers) and Trackers that enable services provided by a third-party (so-called “third-party” Trackers). Unless otherwise specified within this document, third-party providers may access the Trackers managed by them.

The validity and expiration periods of Cookies and other similar Trackers may vary depending on the lifetime set by the Owner or the relevant provider. Some of them expire upon termination of the User’s browsing session.

In addition to what’s specified in the descriptions within each of the categories below, Users may find more precise and updated information regarding lifetime specification as well as any other relevant information – such as the presence of other Trackers – in the linked privacy policies of the respective third-party providers or by contacting the Owner.

To find more information dedicated to Californian consumers and their privacy rights, Users may read the privacy policy.

This Website uses so-called “technical” Cookies and other similar Trackers to carry out activities that are strictly necessary for the operation or delivery of the Service.

This type of service analyzes the traffic of this Website, potentially containing Users’ Personal Data, with the purpose of filtering it from parts of traffic, messages and content that are recognized as SPAM.

Google reCAPTCHA is a SPAM protection service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from.

The use of reCAPTCHA is subject to the Google privacy policy and terms of use.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

This type of service allows this Website to distribute their content using servers located across different countries and to optimize their performance.

Which Personal Data are processed depends on the characteristics and the way these services are implemented. Their function is to filter communications between this Website and the User’s browser.

Considering the widespread distribution of this system, it is difficult to determine the locations to which the contents that may contain Personal Information of the User are transferred.

Cloudflare is a traffic optimization and distribution service provided by Cloudflare Inc.

The way Cloudflare is integrated means that it filters all the traffic through this Website, i.e., communication between this Website and the User’s browser, while also allowing analytical data from this Website to be collected.

Personal Data processed: Tracker and various types of Data as specified in the privacy policy of the service.

Place of processing: United States – Privacy Policy.

iubenda CCPA Cookie (usprivacy) is set by the iubenda Cookie Solution and stores California consumer opt-out choices in the local domain.

Personal Data processed: Tracker.

Place of processing: Italy – Privacy Policy.

Remote iubenda consent Cookie (_iub_cs-X) is set by the iubenda Cookie Solution and stores User preferences related to Trackers under the .iubenda.com domain.

Personal Data processed: Tracker.

Place of processing: Italy – Privacy Policy.

iubenda consent Cookie (_iub_cs-X) is set by the iubenda Cookie Solution and stores User preferences related to Trackers in the local domain.

Personal Data processed: Tracker.

Place of processing: Italy – Privacy Policy.

iubenda ConS JS library localStorage (IUB_DATA) temporarily stores pending data in a storage space internal to the User’s browser (localStorage) until it’s received by the API, then it is deleted.

Personal Data processed: Tracker.

Place of processing: Italy – Privacy Policy.

This Website uses Trackers to enable basic interactions and functionalities, allowing Users to access selected features of the Service and facilitating the User’s communication with the Owner.

By registering on the mailing list or for the newsletter, the User’s email address will be added to the contact list of those who may receive email messages containing information of commercial or promotional nature concerning this Website. Your email address might also be added to this list as a result of signing up to this Website or after making a purchase.

Personal Data processed: email address and Tracker.

This type of service helps the Owner to manage the tags or scripts needed on this Website in a centralized fashion.

This results in the Users’ Data flowing through these services, potentially resulting in the retention of this Data.

Segment is a tag management service provided by Segment.io, Inc.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy.

This Website uses Trackers to provide a personalized user experience by improving the quality of preference management options, and by enabling interaction with external networks and platforms.

This type of service allows this Website to access Data from your account on a third-party service and perform actions with it.

These services are not activated automatically, but require explicit authorization by the User.

This service allows this Website to connect with the User’s account on the Facebook social network, provided by Facebook, Inc.

Permissions asked: Tracker.

Place of processing: United States – Privacy Policy.

This type of service allows you to view content hosted on external platforms directly from the pages of this Website and interact with them.

This type of service might still collect web traffic data for the pages where the service is installed, even when Users do not use it.

Google Maps is a maps visualization service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that allows this Website to incorporate content of this kind on its pages.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

Google Site Search is a search engine embedding service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that allows this Website to incorporate content of this kind on its pages.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

YouTube is a video content visualization service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that allows this Website to incorporate content of this kind on its pages.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

Vimeo is a video content visualization service provided by Vimeo, LLC that allows this Website to incorporate content of this kind on its pages.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy.

This type of service allows Users to interact with data collection platforms or other services directly from the pages of this Website for the purpose of saving and reusing data.

If one of these services is installed, it may collect browsing and Usage Data in the pages where it is installed, even if the Users do not actively use the service.

The Mailchimp widget is a service for interacting with the Mailchimp email address management and message sending service provided by The Rocket Science Group LLC.

Personal Data processed: email address, first name, last name and Tracker.

Place of processing: United States – Privacy Policy.

This type of service allows interaction with social networks or other external platforms directly from the pages of this Website.

The interaction and information obtained through this Website are always subject to the User’s privacy settings for each social network.

This type of service might still collect traffic data for the pages where the service is installed, even when Users do not use it.

It is recommended to log out from the respective services in order to make sure that the processed data on this Website isn’t being connected back to the User’s profile.

The Facebook Like button and social widgets are services allowing interaction with the Facebook social network provided by Facebook, Inc. or by Facebook Ireland Ltd, depending on the location this Website is accessed from,

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

The Twitter Tweet button and social widgets are services allowing interaction with the Twitter social network provided by Twitter, Inc.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy.

The LinkedIn button and social widgets are services allowing interaction with the LinkedIn social network provided by LinkedIn Corporation.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy.

This Website uses Trackers to measure traffic and analyze User behavior with the goal of improving the Service.

The services contained in this section enable the Owner to monitor and analyze web traffic and can be used to keep track of User behavior.

Google Analytics is a web analysis service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, (“Google”). Google utilizes the Data collected to track and examine the use of this Website, to prepare reports on its activities and share them with other Google services.

Google may use the Data collected to contextualize and personalize the ads of its own advertising network.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy – Opt Out; Ireland – Privacy Policy – Opt Out.

Google Ads conversion tracking is an analytics service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that connects data from the Google Ads advertising network with actions performed on this Website.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

Google Analytics on this Website has Advertising Reporting Features activated, which collects additional information from the DoubleClick cookie (web activity) and from device advertising IDs (app activity). It allows the Owner to analyze specific behavior and interests Data (traffic Data and Users’ ads interaction Data) and, if enabled, demographic Data (information about the age and gender).

Users can opt out of Google’s use of cookies by visiting Google’s Ads Settings.

Personal Data processed: Tracker, unique device identifiers for advertising (Google Advertiser ID or IDFA, for example) and various types of Data as specified in the privacy policy of the service.

Place of processing: United States – Privacy Policy – Opt Out; Ireland – Privacy Policy – Opt Out.

Google Analytics Demographics and Interests reports is a Google Advertising Reporting feature that makes available demographic and interests Data inside Google Analytics for this Website (demographics means age and gender Data).

Users can opt out of Google’s use of cookies by visiting Google’s Ads Settings.

Personal Data processed: Tracker and unique device identifiers for advertising (Google Advertiser ID or IDFA, for example).

Place of processing: United States – Privacy Policy – Opt Out; Ireland – Privacy Policy – Opt Out.

Wordpress Stats is an analytics service provided by Automattic Inc. or by Aut O’Mattic A8C Ireland Ltd., depending on the location this Website is accessed from.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

The services contained in this section allow the Owner, through the use of third-party Trackers, to collect and manage analytics in an anonymized form.

Google Analytics is a web analysis service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, (“Google”). Google utilizes the Data collected to track and examine the use of this Website, to prepare reports on its activities and share them with other Google services.

Google may use the Data collected to contextualize and personalize the ads of its own advertising network.

This integration of Google Analytics anonymizes your IP address. It works by shortening Users’ IP addresses within member states of the European Union or in other contracting states to the Agreement on the European Economic Area. Only in exceptional cases will the complete IP address be sent to a Google server and shortened within the US.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy – Opt Out; Ireland – Privacy Policy – Opt Out.

The services contained in this section allow the Owner to track and analyze the User response concerning web traffic or behavior regarding changes to the structure, text or any other component of this Website.

Google Optimize is an A/B testing service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, (“Google”).

Google may use Personal Data to contextualize and personalize the ads of its own advertising network.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

Google Optimize 360 is an A/B testing service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, (“Google”).

This service allows the Owner to target groups of Users on the base of their past use of this Website. Users that opt-out of tracking by Google Analytics will not be included in experiments created in Google Optimize 360.

Google may use Personal Data to contextualize and personalize the ads of its own advertising network.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

This Website uses Trackers to deliver personalized marketing content based on User behavior and to operate, serve and track ads.

Some of the advertising services used by the Owner adhere to the IAB Transparency and Consent Framework, an initiative that facilitates responsible privacy practices across the digital advertising industry – providing Users with enhanced transparency and control over how their data are used for advertising tracking purposes. Users can customize their advertising preferences at any time by accessing the advertising preferences panel from within the cookie notice or via the relevant link on this Website.

This Website participates in the IAB Europe Transparency & Consent Framework and complies with its Specifications and Policies. This Website uses iubenda (identification number 123) as a Consent Management Platform.

This type of service allows User Data to be utilized for advertising communication purposes. These communications are displayed in the form of banners and other advertisements on this Website, possibly based on User interests.

This does not mean that all Personal Data are used for this purpose. Information and conditions of use are shown below.

Some of the services listed below may use Trackers to identify Users or they may use the behavioral retargeting technique, i.e. displaying ads tailored to the User’s interests and behavior, including those detected outside this Website. For more information, please check the privacy policies of the relevant services.

In addition to any opt-out feature offered by any of the services below, Users may opt out by visiting the Network Advertising Initiative opt-out page.

Users may also opt-out of certain advertising features through applicable device settings, such as the device advertising settings for mobile phones or ads settings in general.

Google Ad Manager is an advertising service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that allows the Owner to run advertising campaigns in conjunction with external advertising networks that the Owner, unless otherwise specified in this document, has no direct relationship with. In order to opt out from being tracked by various advertising networks, Users may make use of Youronlinechoices. In order to understand Google’s use of data, consult Google’s partner policy.

This service uses the “DoubleClick” Cookie, which tracks use of this Website and User behavior concerning ads, products and services offered.

Users may decide to disable all the DoubleClick Cookies by going to: Google Ad Settings.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

Similar audiences is an advertising and behavioral targeting service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that uses Data from Google Ads Remarketing in order to display ads to Users with similar behavior to Users who are already on the remarketing list due to their past use of this Website.

On the basis of this Data, personalized ads will be shown to Users suggested by Google Ads Similar audiences.

Users who don’t want to be included in Similar audiences can opt out and disable the use of advertising cookies by going to: Google Ad Settings.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy – Opt Out; Ireland – Privacy Policy – Opt Out.

Google Campaign Manager 360 is an advertising service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that allows the Owner to run advertising campaigns in conjunction with external advertising networks that the Owner, unless otherwise specified in this document, has no direct relationship with. Google Campaign Manager 360 also allows the Owner to measure the campaign’s performance, to set up placements, ads, and creatives, and to verify tag implementations (such as errors in the ad’s formatting). This Website is collecting and transmitting Data from the User through Google Campaign Manager 360 to media buyers bidding to purchase its inventory. These buyers may collect and store such Data and use such Data for retargeting or other advertising purposes.

Users may decide to disable all the ad personalization Cookies by going to: Google Ad Settings.

Personal Data processed: geographic position, Tracker and Usage Data.

Place of processing: United States – Privacy Policy; Ireland – Privacy Policy.

LinkedIn Ads is an advertising service provided by LinkedIn Ireland Unlimited Company or by LinkedIn Corporation, depending on the location this Website is accessed from.

Personal Data processed: Tracker and Usage Data.

Place of processing: Ireland – Privacy Policy – Opt out; United States – Privacy Policy – Opt out.

This type of service allows this Website and its partners to inform, optimize and serve advertising based on past use of this Website by the User.

This activity is facilitated by tracking Usage Data and by using Trackers to collect information which is then transferred to the partners that manage the remarketing and behavioral targeting activity.

Some services offer a remarketing option based on email address lists.

In addition to any opt-out feature provided by any of the services below, Users may opt out by visiting the Network Advertising Initiative opt-out page.

Users may also opt-out of certain advertising features through applicable device settings, such as the device advertising settings for mobile phones or ads settings in general.

Google Ad Manager Audience Extension is a remarketing and behavioral targeting service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that tracks the visitors of this Website and allows selected advertising partners to display targeted ads across the web to them.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy – Opt Out; Ireland – Privacy Policy – Opt Out.

Google Ads Remarketing is a remarketing and behavioral targeting service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that connects the activity of this Website with the Google Ads advertising network and the DoubleClick Cookie.

Users can opt out of Google’s use of cookies for ads personalization by visiting Google’s Ads Settings.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy – Opt Out; Ireland – Privacy Policy – Opt Out.

Remarketing with Google Analytics is a remarketing and behavioral targeting service provided by Google LLC or by Google Ireland Limited, depending on the location this Website is accessed from, that connects the tracking activity performed by Google Analytics and its Cookies with the Google Ads advertising network and the Doubleclick Cookie.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy – Opt Out; Ireland – Privacy Policy – Opt Out.

LinkedIn Website Retargeting is a remarketing and behavioral targeting service provided by LinkedIn Corporation that connects the activity of this Website with the LinkedIn advertising network.

Personal Data processed: Tracker and Usage Data.

Place of processing: United States – Privacy Policy – Opt Out.

There are various ways to manage Tracker related preferences and to provide and withdraw consent, where relevant:

Users can manage preferences related to Trackers from directly within their own device settings, for example, by preventing the use or storage of Trackers.

Additionally, whenever the use of Trackers is based on consent, Users can provide or withdraw such consent by setting their preferences within the cookie notice or by updating such preferences accordingly via the relevant consent-preferences widget, if available.

It is also possible, via relevant browser or device features, to delete previously stored Trackers, including those used to remember the User’s initial consent.

Other Trackers in the browser’s local memory may be cleared by deleting the browsing history.

With regard to any third-party Trackers, Users can manage their preferences and withdraw their consent via the related opt-out link (where provided), by using the means indicated in the third party’s privacy policy, or by contacting the third party.

Users can, for example, find information about how to manage Cookies in the most commonly used browsers at the following addresses:

Users may also manage certain categories of Trackers used on mobile apps by opting out through relevant device settings, such as the device advertising settings for mobile devices, or tracking settings in general (Users may open the device settings, view and look for the relevant setting).

Notwithstanding the above, Users may follow the instructions provided by YourOnlineChoices (EU), the Network Advertising Initiative (US) and the Digital Advertising Alliance (US), DAAC (Canada), DDAI (Japan) or other similar services. Such initiatives allow Users to select their tracking preferences for most of the advertising tools. The Owner thus recommends that Users make use of these resources in addition to the information provided in this document.

The Digital Advertising Alliance offers an application called AppChoices that helps Users to control interest-based advertising on mobile apps.

Practice Catapult LLC

444 Cass Street

Suite D

Traverse City, MI 49684

Owner contact email: [email protected]

Since the use of third-party Trackers through this Website cannot be fully controlled by the Owner, any specific references to third-party Trackers are to be considered indicative. In order to obtain complete information, Users are kindly requested to consult the privacy policies of the respective third-party services listed in this document.

Given the objective complexity surrounding tracking technologies, Users are encouraged to contact the Owner should they wish to receive any further information on the use of such technologies by this Website.

Any information that directly, indirectly, or in connection with other information — including a personal identification number — allows for the identification or identifiability of a natural person.

Information collected automatically through this Website (or third-party services employed in this Website), which can include: the IP addresses or domain names of the computers utilized by the Users who use this Website, the URI addresses (Uniform Resource Identifier), the time of the request, the method utilized to submit the request to the server, the size of the file received in response, the numerical code indicating the status of the server’s answer (successful outcome, error, etc.), the country of origin, the features of the browser and the operating system utilized by the User, the various time details per visit (e.g., the time spent on each page within the Application) and the details about the path followed within the Application with special reference to the sequence of pages visited, and other parameters about the device operating system and/or the User’s IT environment.

The individual using this Website who, unless otherwise specified, coincides with the Data Subject.

The natural person to whom the Personal Data refers.

The natural or legal person, public authority, agency or other body which processes Personal Data on behalf of the Controller, as described in this privacy policy.

The natural or legal person, public authority, agency or other body which, alone or jointly with others, determines the purposes and means of the processing of Personal Data, including the security measures concerning the operation and use of this Website. The Data Controller, unless otherwise specified, is the Owner of this Website.

The means by which the Personal Data of the User is collected and processed.

The service provided by this Website as described in the relative terms (if available) and on this site/application.

Unless otherwise specified, all references made within this document to the European Union include all current member states to the European Union and the European Economic Area.

Cookies are Trackers consisting of small sets of data stored in the User’s browser.

Tracker indicates any technology – e.g Cookies, unique identifiers, web beacons, embedded scripts, e-tags and fingerprinting – that enables the tracking of Users, for example by accessing or storing information on the User’s device.

This privacy statement has been prepared based on provisions of multiple legislations, including Art. 13/14 of Regulation (EU) 2016/679 (General Data Protection Regulation).

This privacy policy relates solely to this Website, if not stated otherwise within this document.

Latest update: February 06, 2021

iubenda hosts this content and only collects the Personal Data strictly necessary for it to be provided.